Luxury Recovery – L, V or K?

It’s time for the environment and society to recover, not simply company profits.

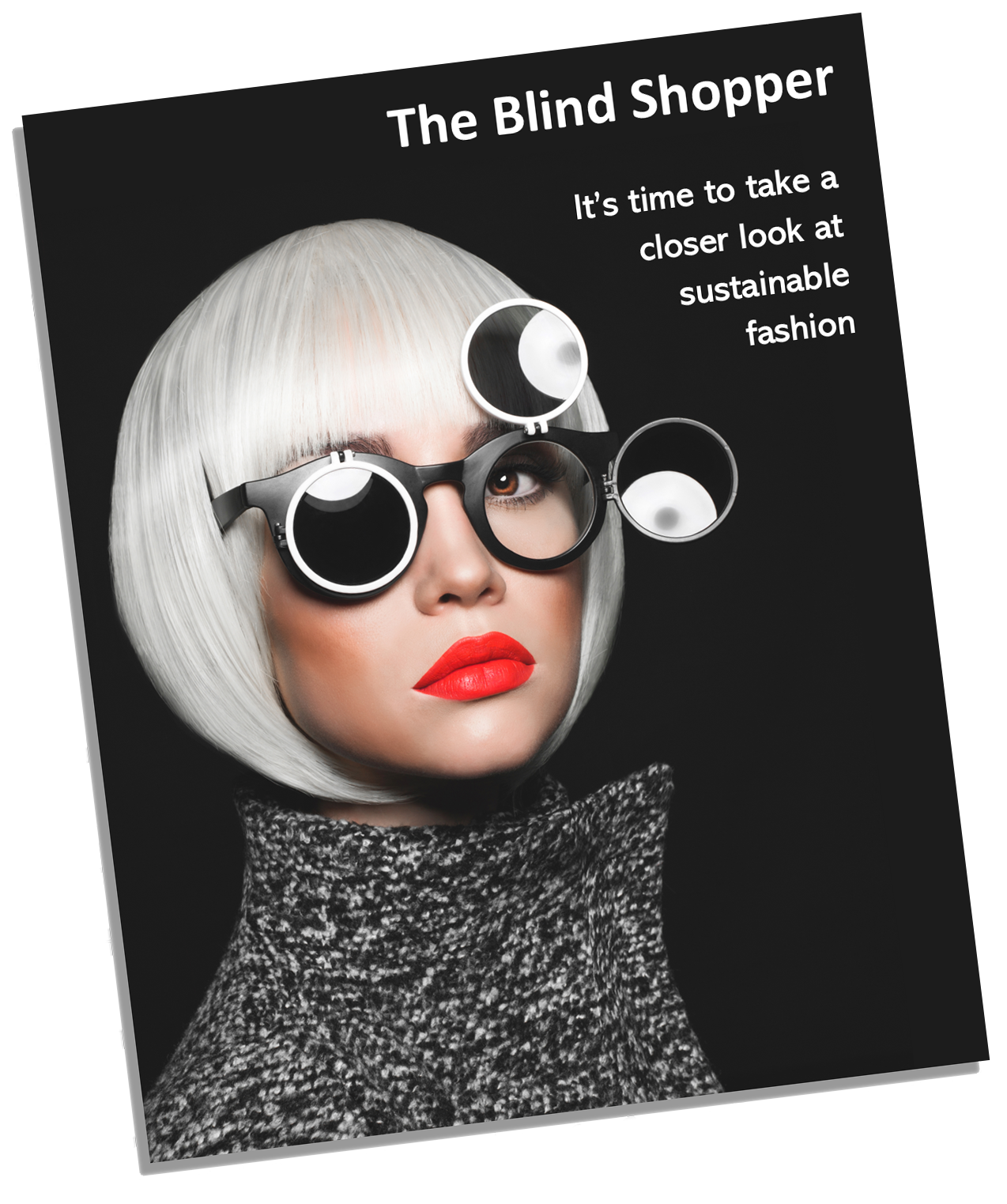

Image DKart

Lynn Johnson

7 November, 2020

While the global pandemic has paradoxically grown the wealth of many on the world’s rich list, and, in turn, their spending on big ticket items such as yachts, much of luxury retail is suffering.

Luxury retail is highly dependent on tourism, with airport sales being a large percentage of spending. As international flights have come to a halt, the luxury industry is pondering the shape of its recovery. And shape is the operative word, with companies hoping for a V-shaped recovery, worried about an L-shaped (no recovery) and landing on the reality of a K-shaped – basically the most wealthy keep spending big, while second tier consumers have a much reduced disposable income.

China domestically is seeing a V-shaped recovery (but a lot of Chinese luxury spending comes via overseas travel of Chinese tourists). Europe is worst hit, with a distinct L-shape and, given the second COVID-19 wave, no recovery for European markets can be expected anytime soon. The US is considered a K-shape, with only the wealthiest still happily spending.

But with luxury consumption having a disproportionately bad impact on the planet and on endangered species, isn’t there a better question to ponder? Is a ‘full recovery’ in luxury spending actually a good idea? So far, there is no evidence that either consumers or industry have learned much from a pandemic that was the direct result of our destructive use of nature. Excessive captive breeding and legal harvesting of wild animals have previously resulted in virus outbreaks and will continue to do so unless we introduce much better protections and monitoring systems very soon.

Image hxyume

Instead, all the talk from business and politicians is about returning ‘back to normal’ as quickly as possible, but ‘normal’ was the problem to start with. If there was one good thing to come out of lockdown, isn’t it the space and time to reflect and rethink?

Social and mainstream media coverage are full of articles about how people are unsettled and anxious; many feeling that they have pressed pause on their lives and that the loss of control is leaving them frustrated, bored, fearful or restless. Is this a really a surprise given the last 10 years have seen an explosion in ‘noise’, which, in turn, has profoundly changed our ability to focus or just simply ‘be’? Work has become much noisier for many, with an upsurge in meetings, emails and messaging.

People have spent years talking about being ‘really busy’, as if longing for some time to take a breath. So instead of following the daily hype on the pandemic and letting anxiety creep in, now is the time to take control – control WHAT you listen to/read and WHAT you think about. There is no better time to learn about HOW we got to where we are today. None of what is in place today happened by accident. Understand the history and politics of the last 40, especially the last 10 years; and understand what is happening right now.

How does this link to luxury spending? The huge variety of items we can buy in shops and online is a result of ‘free market’ capitalism reliant on a lack of regulation that now puts all our health at risk. Why has the drive for ‘free trade’ led to extensive destruction of ecosystems and a looming extinction crisis for up to 1 million species used to create our clothes, accessories, home furnishings and food? Driven by the power of corporations, influence of billionaire funded think-tanks and their political cronies we have been nudged to spend, Spend, SPEND. While these same organisations try to work out how to nudge consumers back to a V-shaped recovery, how many are proving that they have invested in stronger supply chain practices and transparency?

Image winhorse

What are these companies doing, particularly at the ‘raw materials’ end, where a comprehensive understanding of risk and vulnerabilities can help reduce exploitation and biosecurity risks?

Isn’t it time for the environment and society to recover, not simply the profits of a few global luxury brands?

Image van-balvan

Subscribe To

[mc4wp_form id=”29″]