A Brighter Future Is Possible

But Not If You’re Fixated On Building A Property Portfolio!

Image courtneyk

Lynn Johnson

27 June, 2021

Over the next 10 to 20 years, in the wealthiest countries around the world, the ones with the most carbon intensive lifestyles, we will see the largest wealth transfer in history and, most of that money, will go to Generation Y. In the USA alone, Baby Boomers are expected to transfer $68 trillion in wealth to younger generations; for Australia it is conservatively estimated to be $3.5 trillion.

The financial sector, investor groups and business have been gearing up for some time to ensure that they benefit from this intergenerational wealth transfer. They understand that Gen Y prefers to invest in physical assets, such as real estate, gold and diamonds. Gen Y are not as active in the stock market, which is concerning the financial sector. From a business perspective, the Gen Y group on their radar are labelled HENRYs, (High Earners Not Rich Yet). While they are not yet the biggest spenders on luxury goods, they are seen as a priority for this sector, given their future potential.

In the media we are already seeing the property strategy of celebrity Gen Ys being profiled, providing the benchmarks for others to follow. So, Gen Y, as you inherit your wealth in the coming years, how you spend that money will be critical in dealing with climate change, biodiversity loss and social justice.

For those who care about the impacts of these carbon intensive lifestyles, you have to ask yourself, isn’t it time for those with bulging property portfolios to be seen as pariahs? Instead of gaining status, if they lost social status every time they added to their property portfolio, would this change their purchasing behaviour so they would do something more useful for the planet?

As a child growing up in the 1970s UK, I remember a program titled Why Don’t You (just switch off the television set and do something less boring instead). With this in mind, I say to those Gen Y expecting to come into family money in the coming years, why don’t you invest in something much less boring than mainstream property. Here are 2 ideas on how to invest differently.

Idea 1: Buy wilderness, not bricks and mortar.

In the long term, the world will most likely move back to a ‘commons’ approach to land, which means there will no longer be private property rights over natural resources. But, for now, private property rights prevail, and individuals can move faster than political ideologies can change. As such, having wealthier individuals buy the few remaining private parcels of land, to protect their healthy ecosystems, would help slow biodiversity loss.

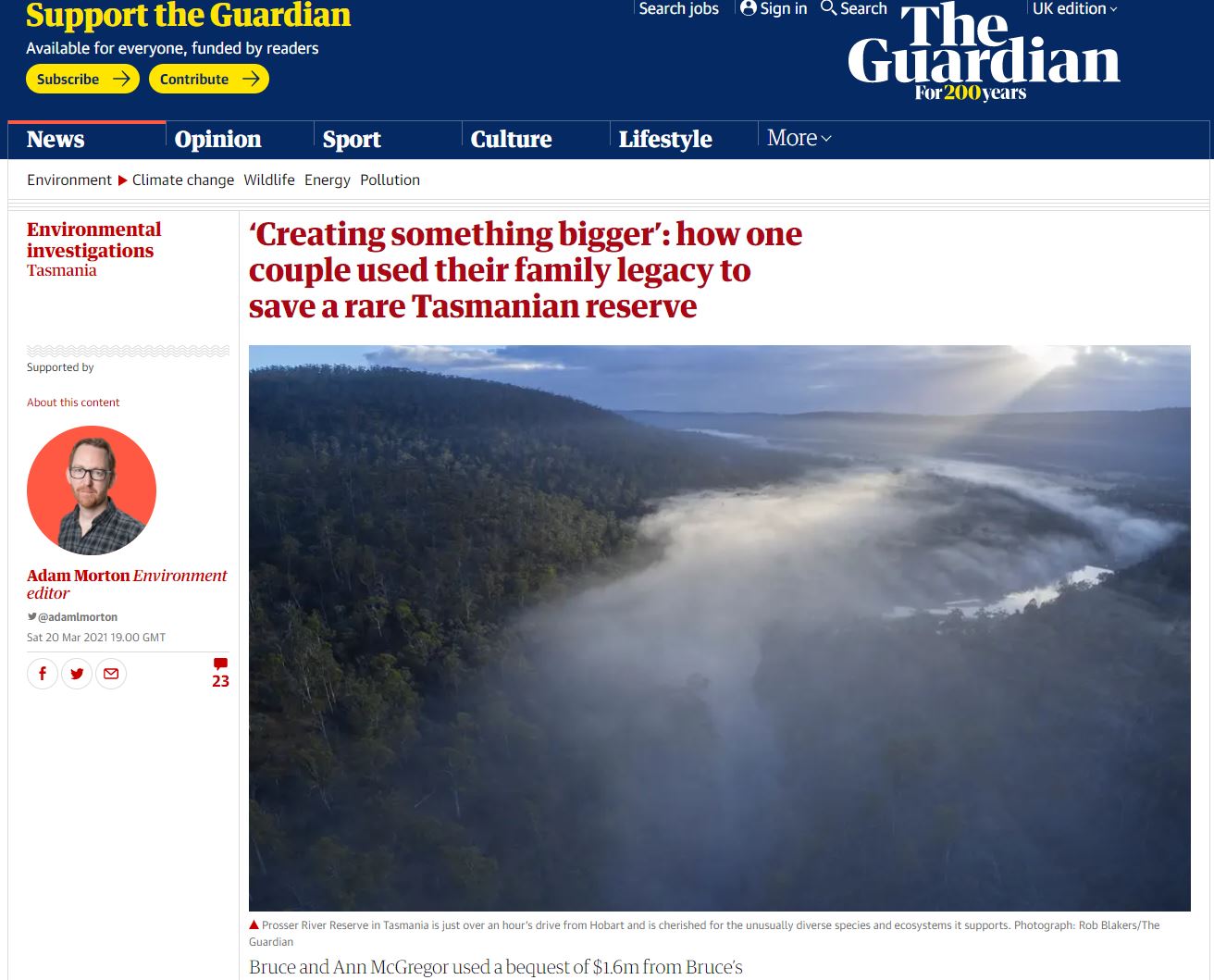

This is happening already, but more people are needed to increase the scale of what is being achieved. Just one wonderful example is that of

Image czardases

Bruce and Ann McGregor, who used a bequest of $1.6m from Bruce’s father to buy Prosser River Reserve. The 1,534-hectare reserve has 6 types of vegetation considered threatened in Tasmania. It is also home to at-risk animal species, including the swift parrot, Tasmanian devil, eastern quoll and eastern-barred bandicoot.

In The Guardian article Bruce says, “We thought ‘here’s a chance to protect something that goes from the top of these stunning hills down to the valley floor”.

On the day I read this story, I checked the Sydney real estate market and for $1.6m the were 17, one-bedroom or two-bedroom apartments for sale. When you compare a one bedroomed apartment to saving a 1,534-hectare nature reserve with at least 11 at-risk plant and animal species, those focused on adding to their inner-city property portfolio seem, frankly, to be as boring as bat shit, to use just one great Australian slang term! Sadly, too few people are making the same commitments as Bruce and Ann McGregor.

Sadder still is the fact that given the scale of destruction, over recent decades, these nature reserves are few and far between. Much of the country surrounding the Prosser River Reserve, purchased by Ann and Bruce, has been cleared for farming.

So, while idea 1 is about saving what is left of the pristine, the next idea is about rewilding the degraded, to help create new wilderness and wildlife corridors.

Idea 2: Buy degraded land and rebuild a wilderness.

A third of the earth’s soil is acutely degraded due to agriculture, with salinity and acidification being key problems. Over a third of the Earth’s soils are already degraded and over 90% could become degraded by 2050; the equivalent of one soccer pitch of soil is eroded every five seconds.

Estimated rates of accelerated soil erosion, on arable or intensively grazed lands, are 100-1,000 times higher than that of natural erosion rates, and soil erosion can lead up to a 50% loss in crop yields.

As a result, when a crop’s profits become too marginal, and life on the land becomes too hard, people migrate to cities and towns.

Image photosbyash

Environmental conditions in some parts of the world mean rewilding is not so hard, sometimes all it takes is to give nature a bit of a helping hand in the beginning. But in other regions, the breadth and depth of biodiversity loss, means the rehabilitation, revegetation and rewilding process will take a longer commitment.

Seeding native grasses and wildflowers, will encourage the return of insects, reptiles, birds and mammals. Planting native shrubs and trees will do the same.

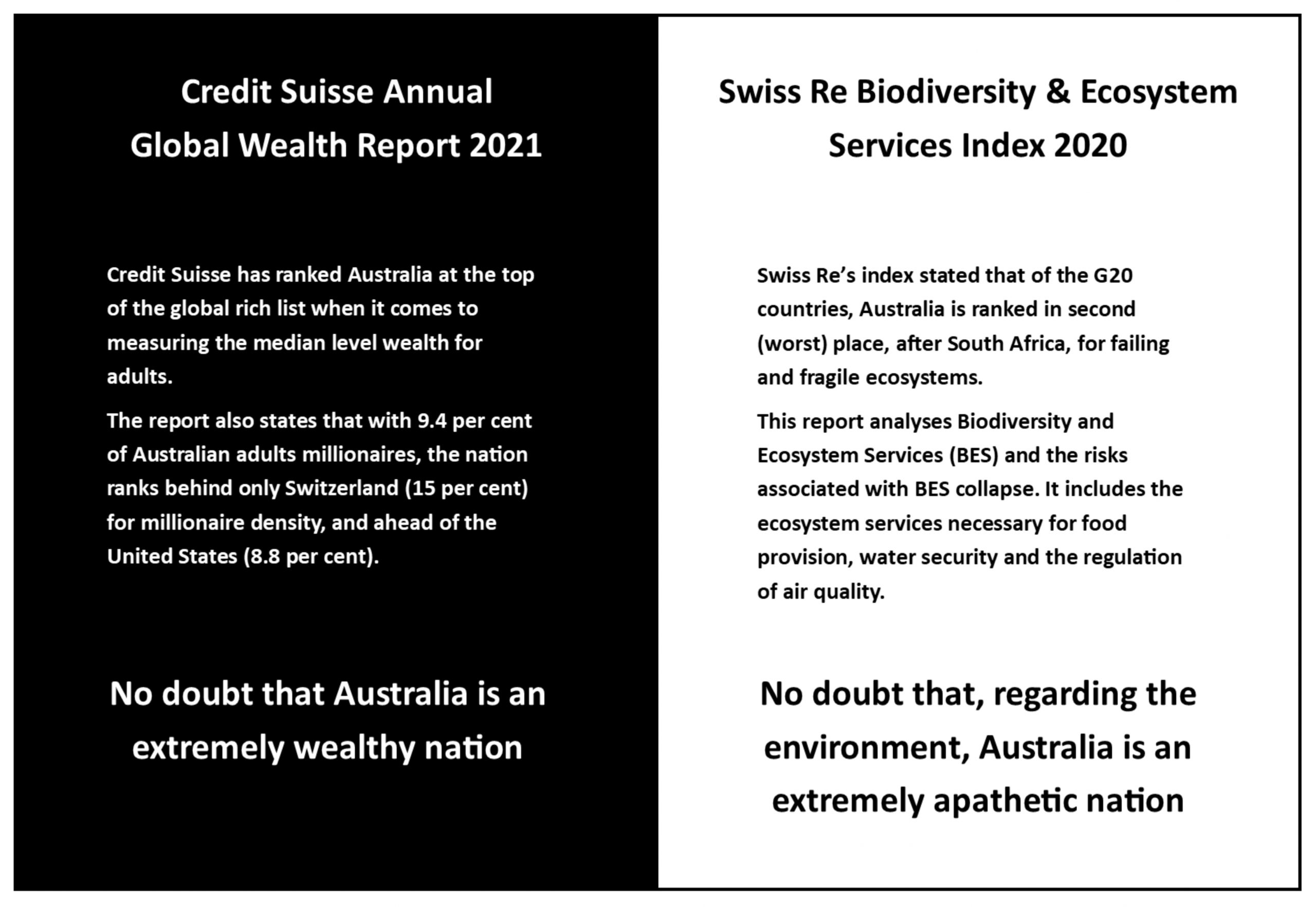

This is a critical discussion to have right now and in Australia in particular. To understand why I say this let’s compare and contrast two facts:

Here we have it in black and white, but unless more people are willing to turn their backs on building property portfolios not much will change. Is Gen Y ready to break this cycle and be more visionary? They can’t say they didn’t know the consequences of maintaining the status quo.

Subscribe To

[mc4wp_form id=”29″]